Why DIY Credit Repair Could Be the Best Decision You Make This Year

Exactly How Credit Scores Fixing Works to Eliminate Mistakes and Boost Your Creditworthiness

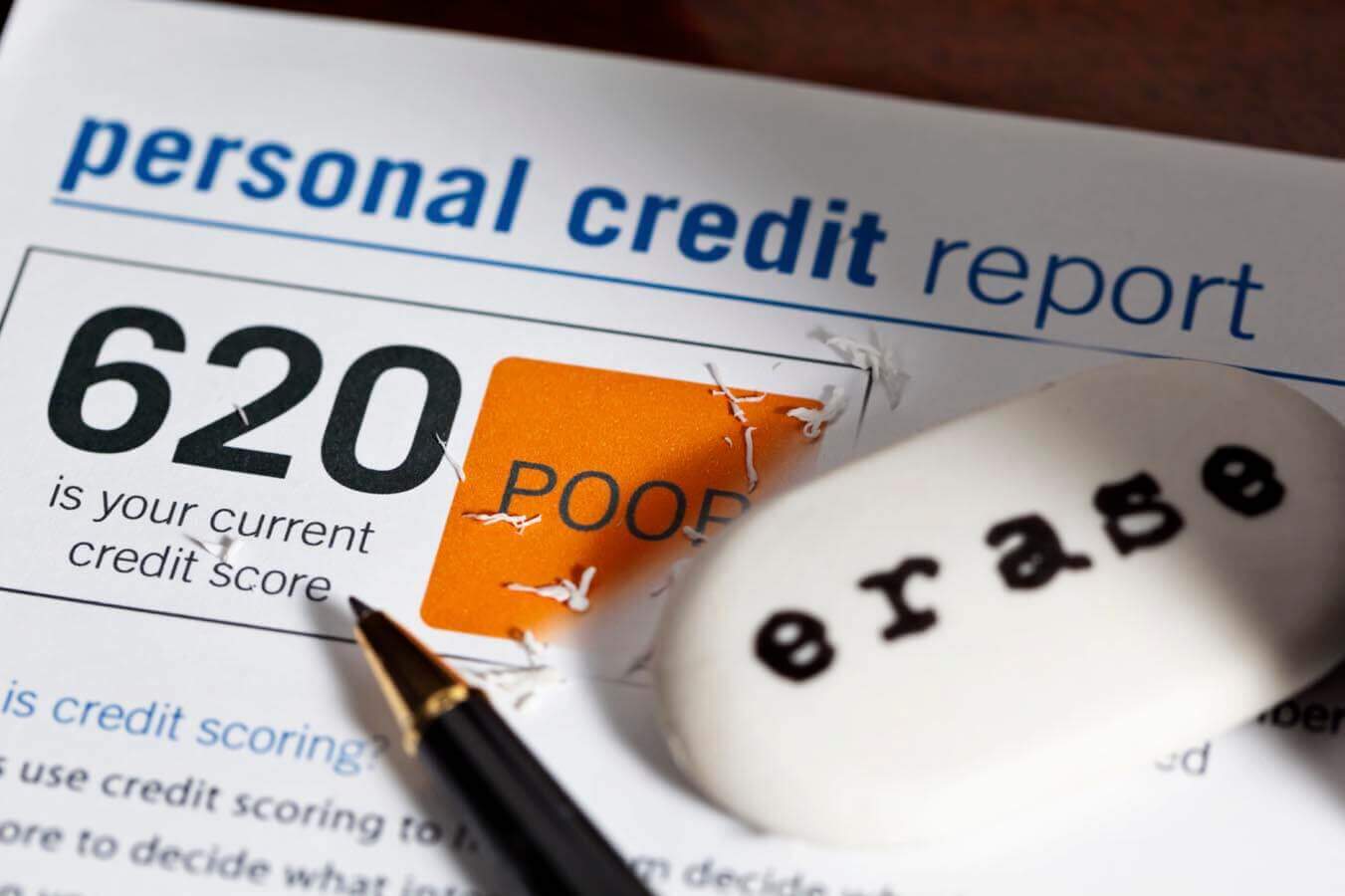

Credit report repair service is an important procedure for individuals looking for to enhance their creditworthiness by dealing with errors that may endanger their economic standing. By carefully checking out credit history records for usual errors-- such as inaccurate individual details or misreported payment histories-- people can initiate a structured disagreement procedure with credit score bureaus.

Recognizing Credit Report Information

Debt reports act as a monetary photo of a person's credit report, describing their borrowing and repayment habits. These records are put together by credit report bureaus and consist of vital information such as charge account, arrearages, payment history, and public documents like liens or insolvencies. Economic establishments use this information to analyze an individual's credit reliability when getting car loans, bank card, or home mortgages.

A credit report normally includes individual info, consisting of the individual's name, address, and Social Protection number, together with a list of debt accounts, their status, and any late repayments. The report additionally describes credit rating questions-- instances where loan providers have accessed the report for examination purposes. Each of these components plays a vital role in determining a credit rating, which is a numerical representation of creditworthiness.

Understanding credit rating reports is important for customers aiming to manage their economic health and wellness efficiently. By on a regular basis evaluating their reports, individuals can ensure that their credit rating accurately mirrors their economic behavior, therefore placing themselves positively in future borrowing ventures. Awareness of the contents of one's credit report is the initial step towards effective debt repair work and overall economic health.

Typical Credit Score Report Mistakes

Errors within credit scores records can significantly impact an individual's credit rating score and overall financial health and wellness. Typical credit history record mistakes consist of inaccurate individual info, such as misspelled names or wrong addresses. These discrepancies can result in confusion and may impact the evaluation of credit reliability.

Another frequent mistake entails accounts that do not come from the individual, frequently arising from identification burglary or unreliable information access by creditors. Combined documents, where one person's credit history info is integrated with another's, can additionally occur, particularly with individuals who share comparable names.

In addition, late repayments may be improperly reported as a result of refining errors or misunderstandings pertaining to payment days. Accounts that have been cleared up or repaid might still look like outstanding, additional making complex an individual's credit profile.

In addition, mistakes pertaining to credit report restrictions and account balances can misrepresent a customer's credit history application ratio, an important consider credit history. Identifying these errors is essential, as they can lead to higher rates of interest, finance denials, and enhanced problem in obtaining credit score. Consistently assessing one's credit scores record is a proactive procedure to identify and correct these typical mistakes, therefore guarding economic wellness.

The Credit Score Repair Process

Navigating the credit rating fixing process can be a daunting task for numerous people seeking to improve their monetary standing. The trip begins with obtaining a thorough debt report from all three major credit bureaus: Equifax, Experian, and TransUnion. Credit Repair. This allows consumers to recognize and recognize the aspects Web Site affecting their credit report

As soon as the credit record is examined, people must classify the info right into accurate, inaccurate, and unverifiable items. Exact information needs to be maintained, while errors can be objected to. It is crucial to gather supporting paperwork to corroborate any kind of cases of error.

Next, people can pick to either manage the procedure independently or employ the help of professional browse around this site credit report repair service solutions. Credit Repair. Professionals usually have the experience and resources to navigate the complexities of credit report reporting laws and can simplify the process

Throughout the credit rating repair service process, keeping prompt repayments on existing accounts is vital. This shows responsible financial actions and can favorably influence credit report. Ultimately, the credit history repair work procedure is a methodical strategy to determining concerns, disputing errors, and cultivating much healthier monetary behaviors, leading to enhanced creditworthiness with time.

Disputing Inaccuracies Properly

A reliable conflict procedure is crucial for those looking to fix inaccuracies on their credit scores records. The initial step entails getting a copy of your credit score report from the significant credit score bureaus-- Equifax, Experian, and TransUnion. Evaluation the report meticulously for any type of disparities, such as inaccurate account information, obsoleted info, or deceptive access.

Once mistakes are determined, it is important to gather supporting documents that corroborates your insurance claims. This may consist of payment invoices, financial institution declarations, or any type of relevant communication. Next off, start the disagreement process by calling the credit bureau that issued the report. This can usually be done online, using mail, or over the phone. When sending your dispute, offer a clear description of the mistake, together with the supporting proof.

Advantages of Credit Report Repair Service

A wide variety of advantages comes with the procedure of credit report repair work, dramatically affecting both financial security and general top quality of life. One of the key advantages is the potential for better credit history. As mistakes and mistakes are dealt with, people can experience a noteworthy boost in their creditworthiness, which directly affects financing approval prices and passion terms.

Additionally, credit report repair work can boost access to beneficial financing options. People with higher credit ratings are a lot more most likely to get approved for lower rate of interest on mortgages, vehicle fundings, and personal finances, eventually leading to substantial cost savings with time. This enhanced Go Here financial adaptability can assist in significant life decisions, such as purchasing a home or investing in education.

Moreover, a healthy and balanced credit profile can enhance self-confidence in monetary decision-making. With a more clear understanding of their credit circumstance, people can make enlightened selections regarding debt usage and administration. Finally, credit repair service typically involves education on monetary literacy, encouraging people to take on far better investing behaviors and keep their credit report health and wellness long-term. In recap, the advantages of credit history repair work expand past plain rating enhancement, contributing to a more safe and prosperous financial future.

Final Thought

To conclude, credit history repair acts as an essential system for enhancing credit reliability by dealing with mistakes within credit scores reports. The organized identification and dispute of mistakes can lead to considerable improvements in credit report, thus helping with access to much better funding alternatives. By comprehending the subtleties of credit scores reports and using efficient conflict approaches, individuals can attain better financial health and security. Ultimately, the credit scores repair process plays a necessary role in fostering notified monetary decision-making and lasting financial wellbeing.

By meticulously taking a look at credit rating records for typical errors-- such as wrong individual details or misreported repayment histories-- individuals can initiate an organized dispute process with credit bureaus.Credit rating records offer as a financial snapshot of an individual's credit rating history, outlining their borrowing and repayment behavior. Recognition of the contents of one's credit history report is the initial step towards effective credit report fixing and total monetary wellness.

Errors within debt records can substantially affect a person's credit history score and overall financial health and wellness.Additionally, errors regarding credit rating limits and account balances can misrepresent a consumer's credit usage proportion, a critical aspect in credit history scoring.